REFERENCE: Ref.02_06

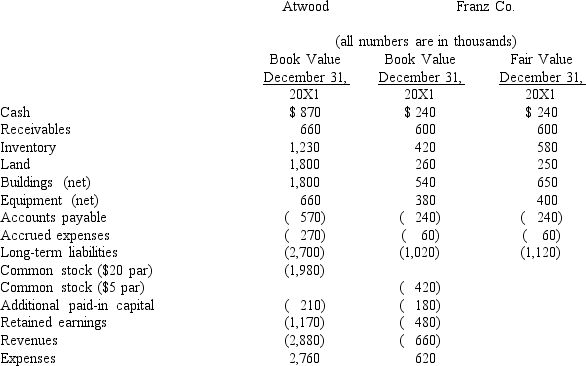

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Assuming Atwood accounts for the combination as an acquisition,compute consolidated goodwill at the date of the combination.

Definitions:

365-Day Year

A conventional method used in finance that assumes all years have 365 days for the purpose of interest calculation.

Exact Simple Interest

Interest calculated precisely on the principal amount, without compounding, for a specific time period.

365-Day Year

A reference to a full calendar year consisting of 365 days, typically excluding leap years which have 366 days.

Exact Simple Interest Rate

The percentage of the principal amount (the initial sum of money borrowed or invested) that is paid as interest for a specified period, not accounting for compound interest.

Q8: What is consolidated net income that is

Q26: For a voluntary health and welfare organization,what

Q40: For a partnership,how should liquidation gains and

Q43: Compute the amount of consolidated buildings (net)at

Q44: Compute the consolidated additional paid-in capital at

Q45: Prepare a schedule to calculate the safe

Q57: On January 1,2009,Cocker issued 10,000 additional shares

Q64: Compute the goodwill recognized in consolidation.<br>A)$800,000<br>B)$310,000.<br>C)$124,000.<br>D)$0.<br>E)$(196,000).

Q67: If the partial equity method has been

Q68: What is the balance of May's capital