REFERENCE: Ref.02_06

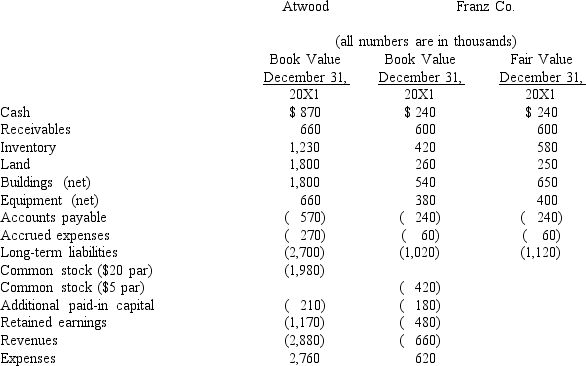

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Compute consolidated equipment (net) at the date of the combination.

Definitions:

Units Sold

The total quantity of a product that has been sold during a particular period, a key measure of business performance.

Absorption Costing

An accounting method that includes all the costs associated with manufacturing a product, including direct, indirect, fixed, and variable costs.

Break-Even Point

The financial point at which total revenues equal total costs, resulting in no net profit or loss.

Variable Costs

Charges that directly correlate with the volume of production or sales, such as direct labor and materials required for production.

Q6: The town of Wakefield opened a solid

Q13: On January 1,2009,Parent Corporation acquired a controlling

Q15: A statutory merger is a(n)<br>A)business combination in

Q29: If a subsidiary reacquires its outstanding shares

Q33: Assume the equity method is applied.How much

Q40: The disadvantages of the partnership form of

Q42: When a parent uses the partial equity

Q53: What three criteria must be met before

Q86: What is meant by unrealized inventory gains,and

Q97: Matthews Co.obtained all of the common stock