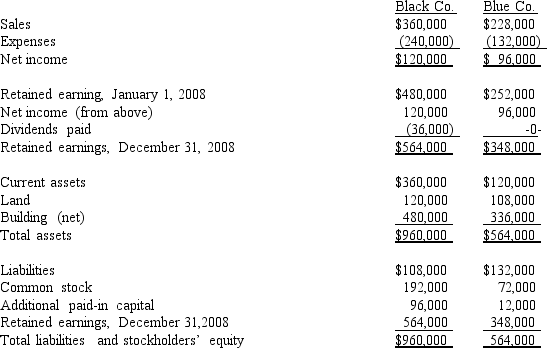

The following are preliminary financial statements for Black Co.and Blue Co.for the year ending December 31,2008.

On December 31,2008 (subsequent to the preceding statements),Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue.Black's stock on that date has a fair value of $60 per share.Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000.Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities,prepare a consolidation worksheet as of December 31,2008 assuming the transaction is treated as a purchase combination.

Definitions:

Contribution Margin Ratio

A ratio that shows the contribution margin as a percentage of total sales, indicating how much of the revenue is available to cover fixed costs and generate profit.

Fixed Expenses

Expenses that do not fluctuate with changes in production volume or sales, such as rent and salaries.

Variable Expenses

Costs that change in proportion to the level and nature of business activity, such as advertising, sales commissions, and shipping costs.

Cost Volume Profit Analysis

A managerial accounting technique used to determine the effects of changes in costs and volume on a company's profits.

Q44: Flintstone Inc.acquired all of Rubble Co.on January

Q45: Under modified accrual accounting,when are expenditures recorded?

Q47: In a liquidation,total free assets are calculated

Q56: Salaries and wages that have been earned

Q96: When consolidating a subsidiary under the equity

Q98: Compute the amount of Hurley's buildings that

Q102: Using the purchase method,goodwill is generally defined

Q102: Compute the December 31,2010 consolidated retained earnings.<br>A)$1,645,375.<br>B)$1,350,000.<br>C)$1,565,375.<br>D)$2,845,375.<br>E)$1,265,375.

Q104: Compute the amortization of gain for 2009

Q106: If a subsidiary issues additional common shares