REFERENCE: Ref.02_08

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1,20X1.To obtain these shares,Flynn pays $400 (in thousands) and issues 10,000 shares of $20 par value common stock on this date.Flynn's stock had a fair value of $36 per share on that date.Flynn also pays $15 (in thousands) to a local investment firm for arranging the transaction.An additional $10 (in thousands) was paid by Flynn in stock issuance costs.

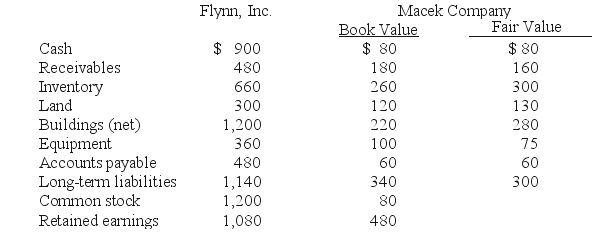

The book values for both Flynn and Macek as of January 1,20X1 follow.The fair value of each of Flynn and Macek accounts is also included.In addition,Macek holds a fully amortized trademark that still retains a $40 (in thousands) value.The figures below are in thousands.Any related question also is in thousands.

SHAPE \* MERGEFORMAT

-Assuming the combination is accounted for as an acquisition,what amount will be reported for goodwill?

Definitions:

World War II

A global conflict that lasted from 1939 to 1945, involving most of the world's nations and resulting in significant shifts in power and the creation of the United Nations.

Marriage Rates

The statistical measure of the number of marriages per unit of population within a specified time frame.

Divorce Rates

A statistical measure that shows the number of divorces that occur in a given population during a specified period.

Federal Government

A system of government where power is divided between a national (federal) government and various regional governments.

Q8: Which entry would be the correct entry

Q12: What was Nolan's share of income for

Q25: On a statement of functional expenses for

Q31: The Abrams,Bartle,and Creighton partnership began the process

Q32: What term is used to refer to

Q48: With regard to the intercompany sale,which of

Q63: When a city received a private donation

Q80: On January 1,2009,Rand Corp.issued shares of its

Q83: Assuming the combination is accounted for as

Q122: When a company applies the initial method