REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

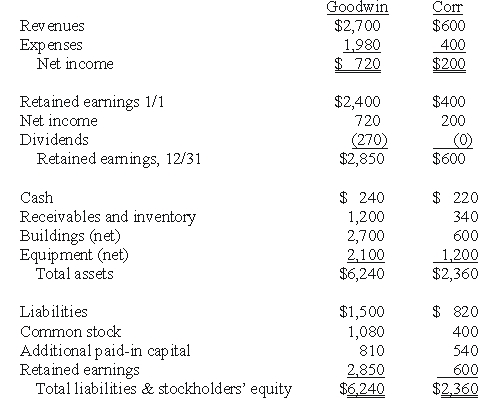

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-If the combination is accounted for as a purchase,at what amount is the investment recorded on Goodwin's books?

Definitions:

Mutually Beneficial

A term describing agreements or situations that provide advantages or gains to all parties involved.

Production Possibilities

outlines the different combinations of goods and services that an economy can produce, given its available resources and technology.

Autos

Short for automobiles, referring to motor vehicles designed for transporting passengers on roads.

Comparative Advantage

The ability of an individual or group to produce a good or service at a lower opportunity cost than others, leading to more efficient trade possibilities.

Q14: For an acquisition when the subsidiary retains

Q25: How is the amortization of goodwill treated

Q25: What is the amount of consolidated net

Q28: Compute the amount of Hurley's land that

Q32: If the equity method had been applied,what

Q38: Matching<br>(1. )The schedule of liquidation<br>(2. )Deficit capital

Q47: Determine the cash to be retained and

Q50: What is Pi's accrual-based income for 2009?<br>A)$152,000.<br>B)$16,000.<br>C)$192,000.<br>D)$200,000.<br>E)$208,000.

Q72: Compute consolidated cost of goods sold.<br>A)$7,500,000.<br>B)$7,600,000.<br>C)$7,615,000.<br>D)$7,604,500.<br>E)$7,660,000.

Q100: Assuming the combination is accounted for as