An inter vivos trust was created by Isaac Posney.Isaac owned a large department store in Juggins,Utah.Adjacent to the store,Isaac also owned a tract of land that was used as an extra parking lot when the store was having a sale or during the Christmas season.Isaac expected the land to appreciate in value and eventually be sold for an office complex or additional stores.

Isaac placed the land into a charitable lead trust which would hold the land for ten years until Isaac's son would turn 21.At that time,title would be transferred to the son.The store will pay rent to use the land during the interim.The income generated each year from this usage will be given to a local church.The land was currently valued at $416,000.

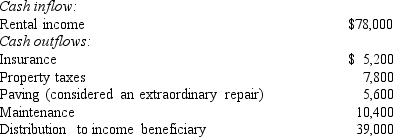

During the first year of this arrangement,the trustee recorded the following cash transactions:

Required:

Prepare all required journal entries for this trust fund including the entry to create the trust.

Definitions:

Collective Responsibility

The concept that individuals in a group share responsibility for actions taken by the group as a whole, including the outcomes of those actions.

Shared Leisure Interests

Shared leisure interests refer to common activities or hobbies that people enjoy during their free time, forming a basis for social connections and community.

Robert Bellah

An American sociologist known for his work on the role of religion in modern society, particularly through the concept of civil religion.

Leisure

Free time when an individual is not working or fulfilling obligations and can choose activities for relaxation, enjoyment, or other personal interests.

Q18: Which type of fund is not included

Q22: Which one of the following is a

Q30: Under the initial value method,when accounting for

Q36: A gift that is specified in a

Q40: King Corp.owns 85% of James Co.King uses

Q41: What are third party payors? Why are

Q70: Assuming the combination is accounted for as

Q80: On January 1,2009,Rand Corp.issued shares of its

Q113: Prepare the journal entries to record (1)the

Q116: Compute consolidated buildings (net)at date of acquisition.<br>A)$2,450.<br>B)$2,340.<br>C)$1,800.<br>D)$650.<br>E)$1,690.