Figure:

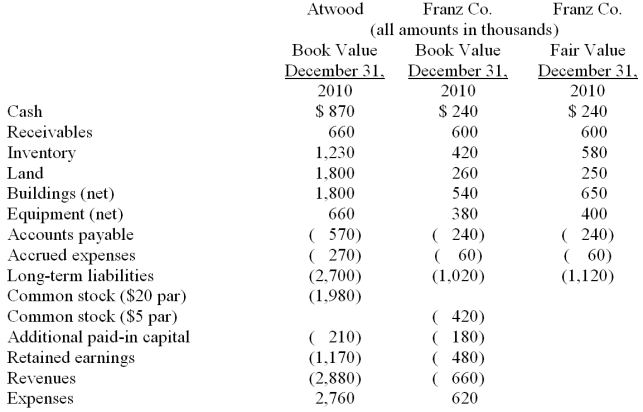

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated buildings (net) at date of acquisition.

Definitions:

United States

A country located in North America, consisting of 50 states and known for its significant cultural and political influence worldwide.

Psychotic Disorder

A mental disorder characterized by a disconnection from reality, often manifesting as delusions or hallucinations.

Prevalence

The proportion of a particular population found to be affected by a specific condition at a specific time.

Delusional Disorder

A psychiatric condition characterized by persistent delusions (beliefs or ideas not based in reality), without other prominent symptoms of psychosis such as hallucinations.

Q10: Which statement below is not correct?<br>A)The accounting

Q12: How much will the consolidated group save

Q16: What consolidation entry would have been recorded

Q41: How much should the mortgage holder expect

Q78: The partnership contract for Hanes and Jones

Q91: Assuming the combination is accounted for as

Q94: Tray Co.reported current earnings of $560,000 while

Q96: What is the consolidated total for inventory

Q108: Where do dividends paid by a subsidiary

Q116: Compute consolidated buildings (net)at date of acquisition.<br>A)$2,450.<br>B)$2,340.<br>C)$1,800.<br>D)$650.<br>E)$1,690.