REFERENCE: Ref.15_03 Hardin,Sutton,and Williams Has Operated a Local Business as a Partnership

REFERENCE: Ref.15_03

Hardin,Sutton,and Williams has operated a local business as a partnership for several years.All profits and losses have been allocated on a 3:2:1 ratio,respectively.Recently,Williams has undergone personal financial problems,and is insolvent.To satisfy Williams' creditors,the partnership has decided to liquidate.

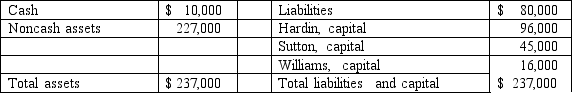

The following balance sheet has been produced:

During the liquidation process,the following transactions take place:

During the liquidation process,the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid.No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Jones,Marge,and Tate LLP decided to dissolve and liquidate the partnership on September 31,2009.After realization of a portion of the noncash assets,the capital account balances were Jones $50,000;Marge $40,000;and Tate $15,000.Cash of $35,000 and other assets with a carrying amount of $100,000 were on hand.Creditors' claims totaled $30,000.Jones,Marge,and Tate shared net income and losses in a 2:1:1 ratio,respectively.

Prepare a working paper to compute the amount of cash that may be paid to creditors and to partners at this time,assuming that no partner is solvent.

Definitions:

Complaint

A formal statement initiating a lawsuit, outlining the plaintiff's allegations against the defendant and the legal remedy sought.

Order

A directive issued by a court or judicial authority requiring someone to do or cease doing something.

Clerk Of The Court

An officer of the court whose responsibilities include maintaining the records of the court and managing oaths of witnesses, jury selections, and sometimes the performance of weddings.

County Judge

A local judicial officer who presides over legal matters within a specific county, often handling probate, civil, and sometimes criminal cases.

Q11: Which one of the following forms is

Q14: Sparkman Co.filed a bankruptcy petition and liquidated

Q14: For an acquisition when the subsidiary retains

Q49: According to the text,which of the following

Q57: How much would James have received from

Q69: What should occur when a solvent partner

Q71: According to GASB Concepts Statement No.1,what are

Q91: Assume (1)that Boerkian was a foreign subsidiary

Q110: Compute the consolidated revenues for 20X1.<br>A)$2,700.<br>B)$720.<br>C)$920.<br>D)$3,300.<br>E)$1,540.

Q116: Compute consolidated buildings (net)at date of acquisition.<br>A)$2,450.<br>B)$2,340.<br>C)$1,800.<br>D)$650.<br>E)$1,690.