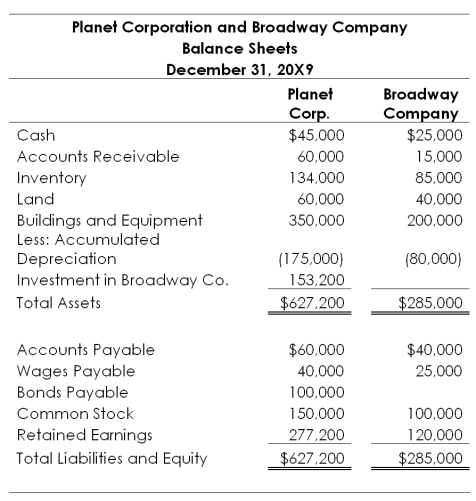

On December 31,20X7,Planet Corporation acquired 80 percent of Broadway Company's stock,at underlying book value.At that date,the fair value of the noncontrolling interest was equal to 20 percent of the book value of Broadway Company.The two companies' balance sheets on December 31,20X9,are as follows:

On December 31,20X9,Planet holds inventory purchased from Broadway for $40,000.Broadway's cost of producing the merchandise was $25,000.Broadway's ending inventory also contains $30,000 of purchases from Planet that had cost it $20,000 to produce.

On December 30,20X9,Broadway sold equipment to Planet for $40,000.Broadway had purchased the equipment for $60,000 several years earlier.At the time of sale to Planet,the equipment had a book value of $20,000.The two companies file separate tax returns and are subject to a 40 percent tax rate.Planet does not record tax expense on its share of Broadway's undistributed earnings.

Required:

1)Prepare the eliminating entries necessary to complete a consolidated balance sheet worksheet as of December 31,20X9.

2)Complete a consolidated balance sheet worksheet as of December 31,20X9.

Definitions:

Unique Cultures

Distinctive ways of life, practices, and beliefs that characterize different societies or organizations.

Functional Department

A segment within an organization structured based on functions, such as marketing, finance, human resources, and production, each led by specialists in those areas.

Product Division

A method of organizing a company by specific products or product lines, allowing for focused management and operational strategies.

Similar Tasks

Activities or duties that share common characteristics, objectives, or outcomes, often requiring a similar set of skills or approaches to be completed.

Q4: Refer to the above information.Tiffany is paid

Q10: Based on the preceding information,what amount will

Q12: On January 1,20X7,Jones Company acquired 90 percent

Q15: Based on the information provided,in the preparation

Q24: When deficiencies are found in a registration

Q25: Based on the information provided,what amount of

Q34: Which of the following statements is (are)correct?<br>I.The

Q37: Based on the information given,what amount will

Q38: Based on the information given above,what amount

Q90: René Descartes:<br>A)was an empiricist.<br>B)introduced the idea of