Use the information below to answer the following question(s) :

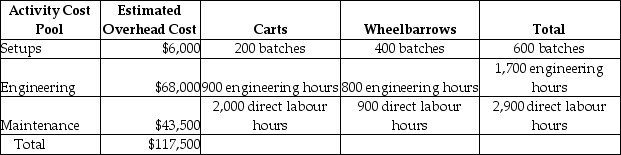

Vittoria Corporation manufactures two products-Carts and Wheelbarrows. The annual production and sales of Carts is 2,000 units, while 1,800 units of Wheelbarrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Carts require 1.0 direct labour hours per unit, while Wheelbarrows require 0.5 direct labour hours per unit. The total estimated overhead for the period is $117,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The cost pool activity rate for engineering costs would be closest to

Definitions:

Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of goods sold by a company, including material and labor costs.

Stockholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing ownership equity.

Net Income

The amount of money a firm earns after deducting all its expenses, taxes, and costs from its total revenue, indicating its profitability during a specific period.

Inventory On Credit

This refers to inventory purchased by a company for which payment is deferred to a later date, typically impacting the accounts payable.

Q22: One cost that is irrelevant in decision

Q26: The predetermined overhead allocation rate using the

Q56: Assuming no other use for its facilities,

Q75: Assuming there is excess capacity at Woodson

Q76: If the Mountaintop golf course is a

Q80: Outsourcing decisions are sometimes referred to as<br>A)

Q107: Transferred-in costs are incurred in a previous

Q141: Which of the following would be appropriately

Q149: When pricing a product or service, managers

Q235: Which of the following best describes an