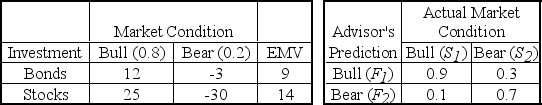

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather. His investment advisor has identified two alternatives and constructed the following tables which show (1) expected profits (in $10,000's) for various market conditions and their probabilities,and (2) the advisor's track record on predicting Bull and Bear markets.  The probability that the advisor predicts a Bull market and the Bull market is the actual condition p(F1ᴖS1) is ________.

The probability that the advisor predicts a Bull market and the Bull market is the actual condition p(F1ᴖS1) is ________.

Definitions:

Machinery

Heavy and complex machines or equipment used in various industries for manufacturing, construction, or specific tasks requiring mechanical force.

Book Value

The value of an asset as recorded on the balance sheet, calculated by subtracting any associated depreciation or amortization from its original cost.

Straight-line Method

A depreciation method that allocates an equal amount of the asset's cost to each year of its useful life.

Annual Rate

The rate of interest or growth a financial asset or liability would achieve over a period of one year.

Q1: In which condition would you be least

Q8: When Southwest Airlines sends a five-item questionnaire

Q38: Anita Cruz recently assumed responsibility for

Q44: Ray Crofford is evaluating investment alternatives for

Q46: What is the forecast for the Period

Q54: Sam Hill,Director of Media Research,is analyzing

Q76: A researcher wants to study the effects

Q82: Consider the following decision table with rewards

Q83: When the error terms of a regression

Q86: A researcher wants to determine whether the