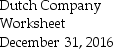

The following extract was taken from the worksheet of Dutch Company for the year 2016.

From the above information,determine the amount of the Rent Expense adjustment.

Definitions:

ADH

Antidiuretic hormone, a peptide hormone that helps regulate and balance the amount of water in the body by controlling water reabsorption in the kidneys.

Water Reabsorption

The process by which water is absorbed from the filtrate in the kidneys back into the blood.

Plasma Osmolality

A measure of the concentration of solutes in blood plasma, important for maintaining proper fluid balance and osmotic pressure in the body.

ADH Production

The process by which the posterior pituitary gland secretes antidiuretic hormone (ADH), which helps control the balance of water in the body by affecting the kidneys.

Q15: An asset account is increased by a

Q60: What is the calculation for return on

Q87: A shortened form of the ledger is

Q89: The worksheet is a useful step in

Q98: The closing process helps in measuring each

Q114: Under the perpetual inventory system,what is the

Q125: The equity of Autumn Company is $130,000

Q126: What is the result if the amount

Q145: Which of the following is an asset

Q146: Financial statements are prepared after an entity's