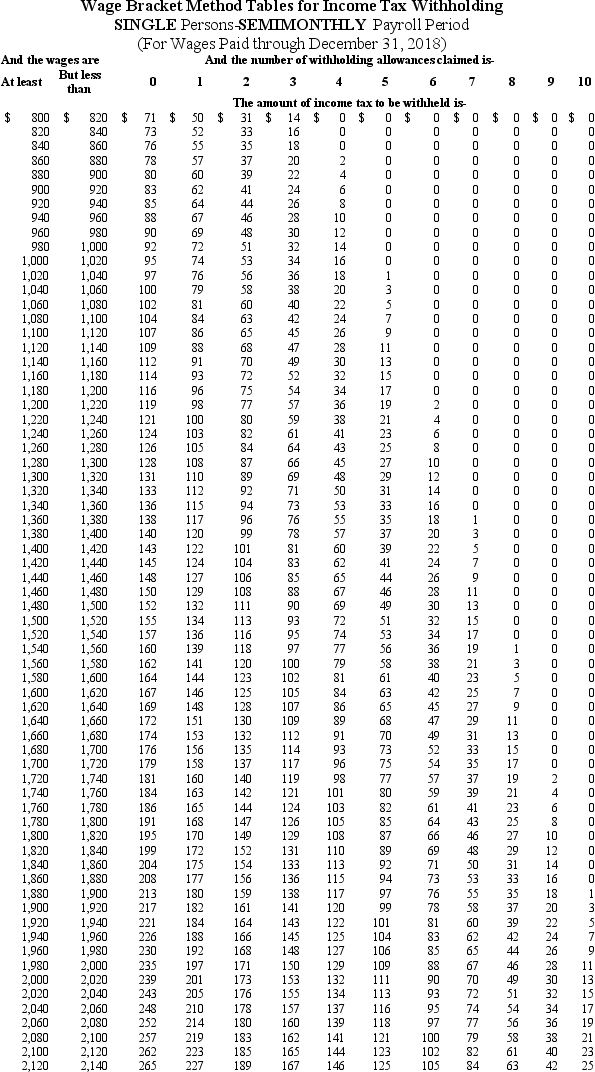

Max earned $1,019.55 during the most recent semimonthly pay period.He is single with 1 withholding allowance and has no pre-tax deductions.Using the following table,how much should be withheld for federal income tax?

Definitions:

Profit Projections

Forecasts of a company's net income over a specific future period.

Tax-Deductible Expense

An expense that can be subtracted from taxable income, effectively reducing the overall tax liability.

Debt Financing

Raising capital through the borrowing of funds to be repaid with interest over time.

FIFO Method

First In, First Out, an inventory valuation method where the oldest inventory is sold first.

Q4: Financial ratio analysis is a form of

Q18: Which of these accounts is increased by

Q22: What is the term for a tax-favorable

Q28: Which of the following are post-tax deductions?

Q42: Hattie Bowers is a government employee who

Q49: Max earned $1,019.55 during the most recent

Q53: Shares of ownership are evidenced by issuing<br>A)bonds

Q72: The two focuses of payroll procedures are

Q87: The Fortune Company reported the following income

Q92: The drawback of studying absolute amounts reported