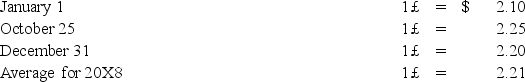

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1,20X8,for $1,100,000.The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition.On January 1,20X8,the book values of its identifiable assets and liabilities approximated their fair values.As a result of an analysis of functional currency indicators,Leo determined that the British pound was the functional currency.On December 31,20X8,the British subsidiary's adjusted trial balance,translated into U.S.dollars,contained $17,000 more debits than credits.The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25,20X8.Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds.Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount.Exchange rates at various dates during 20X8 follow:

-Based on the preceding information,on Leo's consolidated balance sheet at December 31,20X8,what amount should be reported for the goodwill acquired on January 1,20X8?

Definitions:

Customers Served

The number of unique clients or customers that a business or service has provided for over a specific period.

Revenue Variance

The variance between projected revenue and the actual income received.

Fixed Costs

Expenses that do not change with the level of production or sales, such as rent, salaries, and insurance.

Variable Costs

Costs that vary directly with the level of production or sales volume, such as raw materials and direct labor.

Q1: Which of the following statements best describes

Q12: Based on the information given,which consolidating entry

Q22: "Net asset classifications per ASC 958-205" describes

Q23: Based on the information given above,what amount

Q25: Based on the preceding information,what amount will

Q37: Based on the information given above,what amount

Q41: Transaction: Depreciation expense was recorded for the

Q41: Based on the preceding information,what amount of

Q44: Net income for Levin-Tom partnership for 20X9

Q62: Which of the following items would not