On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

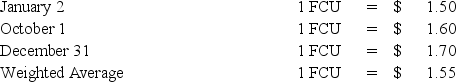

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

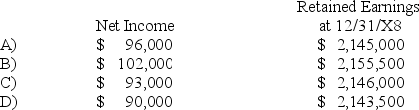

-Refer to the above information.Assuming the FCU of the country in which Ski Company is located is the functional currency,what are the translated amounts for the items below in U.S.dollars?

Definitions:

Low-Income Households

Low-income households are those with total income levels significantly below the national average, often struggling to meet basic necessities such as food, housing, and healthcare.

Higher-Income Households

Families or living arrangements with financial earnings significantly above the average for their area or society.

Teen Abortion Rate

The number of abortion procedures reported among teenagers per a standardized population size.

Imaginary Audience

A cognitive bias commonly found in adolescents, where they believe their behavior is the focus of others' attention more than it actually is.

Q2: Pratt Corporation owns 75 percent of Swan

Q9: At the end of the fiscal year,uncollected

Q10: Peter Architectural Services owns 100 percent of

Q10: Based on the preceding information,the ending balance

Q13: Based on the information provided,the gain on

Q26: A voluntary health and welfare organization received

Q41: Based on the information given above,in the

Q47: Based on the information given above,what amount

Q48: Based on the preceding information,what is the

Q49: Based on the preceding information,what amounts will