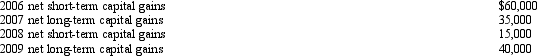

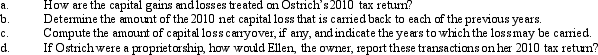

Ostrich,a C corporation,has a net short-term capital gain of $40,000 and a net long-term capital loss of $180,000 during 2010.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Definitions:

Sociality Corollary

Suggests individuals' identities and perceptions are shaped through social interactions and relationships.

Construe Constructions

The process of interpreting or understanding meanings and intentions within verbal or non-verbal communication.

Instinctual Perceptions

The automatic, innate responses and feelings about people or situations, without conscious reasoning.

Hierarchy of Needs

A model proposed by Abraham Maslow arranging human needs in a pyramid, with basic needs at the bottom and self-actualization at the top.

Q2: Gold Corporation,Silver Corporation,and Platinum Corporation are equal

Q31: Meagan purchased her partnership interest from Lisa

Q43: Which of the following real property could

Q64: For the following exchanges,indicate which qualify as

Q69: Hardy's basis in his partnership interest was

Q84: During the current year,Yellow Company had operating

Q90: A distribution in excess of E &

Q115: Under what circumstances are corporations exempt from

Q119: Kevin's AGI is $285,000.He contributed $150,000 in

Q136: Partner Bob purchased his partnership interest for