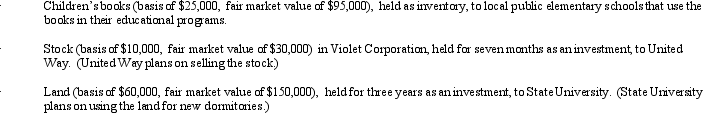

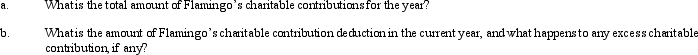

During the current year,Flamingo Corporation,a regular corporation in the book publishing business,made charitable contributions to qualified organizations as follows:

Flamingo Corporation's taxable income (before any charitable contribution)is $1 million.

Flamingo Corporation's taxable income (before any charitable contribution)is $1 million.

Definitions:

Q47: In September,Dorothy purchases a building for $900,000

Q62: Which of the following would extinguish the

Q74: Shawn,a sole proprietor,is engaged in a service

Q90: Jamie owns a 40% interest in the

Q90: If circulation expenditures are amortized over a

Q93: Unlike individual taxpayers,corporate taxpayers do not receive

Q106: Which of the following events could result

Q119: Kevin's AGI is $285,000.He contributed $150,000 in

Q147: Which of the following statements,if any,about an

Q149: A partner has a profit-sharing percent,a loss-sharing