Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

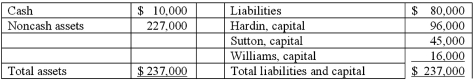

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Definitions:

Alcoholics

individuals who suffer from alcoholism, characterized by a physical or psychological dependency on alcoholic substances.

Substance Abuse

The harmful or hazardous use of psychoactive substances, including alcohol and illicit drugs, leading to addiction or dependency.

Self-Confidence

The belief in one's abilities, qualities, and judgment, empowering them to face challenges with assurance.

Abuse

Action or inaction of an adult that causes serious physical or emotional harm to a child.

Q11: A(n) _ is a visual display of

Q13: Under the temporal method, how would cost

Q22: The Henry, Isaac, and Jacobs partnership was

Q38: What is the justification for the remeasurement

Q67: Non-business-related messages:<br>A) Are not appropriate for the

Q68: Hardin, Sutton, and Williams have operated a

Q75: Common portable communication devices include:<br>A) Cell phones<br>B)

Q89: What happens when a U.S. company sells

Q92: Gargiulo Company, a 90% owned subsidiary of

Q98: Whatever you produce is called output.