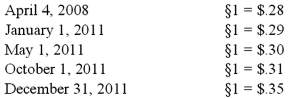

Boerkian Co. started 2011 with two assets: Cash of §26,000 (Stickles) and Land that originally cost §72,000 when acquired on April 4, 2008. On May 1, 2011, the company rendered services to a customer for §36,000, an amount immediately paid in cash. On October 1, 2011, the company incurred an operating expense of §22,000 that was immediately paid. No other transactions occurred during the year so an average exchange rate is not necessary. Currency exchange rates were as follows:

Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the stickle (§) was the functional currency of the subsidiary. Calculate the translation adjustment for this subsidiary for 2011 and state whether this is a positive or a negative adjustment.

Definitions:

Centimeter

A unit of length in the metric system, equivalent to one hundredth of a meter, used commonly to measure small distances.

Inches

A unit of length in the Imperial and United States customary systems, equivalent to 1/12 of a foot.

Microgram

A unit of mass equal to one millionth of a gram.

Milligram

A mass measurement in the metric system equivalent to 0.001 grams.

Q23: Parker Corp., a U.S. company, had the

Q29: On March 1, 2011, Mattie Company received

Q48: A partnership began its first year of

Q50: Westmore, Ltd. is a British subsidiary of

Q73: Do not eat or tend to personal

Q78: Ignoring an e-mail message is rude and

Q92: Cashen Co. paid $2,400,000 to acquire all

Q94: Walsh Company sells inventory to its subsidiary,

Q115: Denber Co. acquired 60% of the common

Q115: Which of the following statements is false