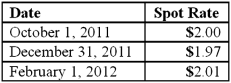

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

What is the amount of Cost of Goods Sold for 2012 as a result of these transactions?

Definitions:

Individualist Culture

Individualist culture emphasizes personal achievements and independence, valuing individual rights above those of the group.

Self-serving Bias

A cognitive bias that involves attributing successes to internal factors and failures to external factors to maintain self-esteem.

Halo Effect

A cognitive bias in which an observer's overall impression of a person, company, brand, or product influences the observer's feelings and thoughts about that entity's character or properties.

Initial Attraction

The first phase of attraction towards someone, usually based on physical appearance, which can lead to interest or desire for a closer relationship.

Q5: The Town of Portsmouth has at the

Q6: How does a foreign currency forward contract

Q40: Ginvold Co. began operating a subsidiary in

Q46: The partners of Donald, Chief & Berry

Q49: What three criteria must be met to

Q62: Participation in a Wiki is a form

Q78: Which of the following statements is false

Q91: Prevatt, Inc. owns 80% of Franklin Company.

Q95: Perry Company acquires 100% of the stock

Q114: For an acquisition when the subsidiary retains