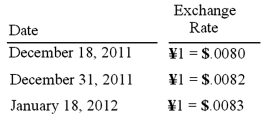

Gaw Produce Company purchased inventory from a Japanese company on December 18, 2011. Payment of 4,000,000 yen (¥) was due on January 18, 2012. Exchange rates between the dollar and the yen were as follows:

Required:

Prepare all journal entries for Gaw Produce Co. in connection with the purchase and payment.

Definitions:

Stock Splits

A corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares, though the overall value of the company does not change.

Reverse Split

A reverse split is a consolidation of a company's existing share into fewer, proportionally more valuable shares.

Administrative Problems

Challenges or obstacles that occur in the management, organization, or operation of a business or any institutional setup.

Tax Basis

The value of an asset for tax purposes, used to calculate depreciation, amortization, and gains or losses on the sale of the asset.

Q2: Under the current rate method, how would

Q11: Webb Company owns 90% of Jones Company.

Q22: Watkins, Inc. acquires all of the outstanding

Q28: The advantages of the partnership form of

Q37: Stark Company, a 90% owned subsidiary of

Q40: Ginvold Co. began operating a subsidiary in

Q45: The ABCD Partnership has the following balance

Q55: On January 1, 2011, Pride, Inc. acquired

Q71: What documents or other sources of information

Q83: Perch Co. acquired 80% of the common