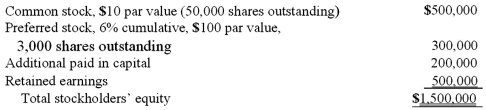

On January 1, 2009, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:

The consolidation entry at date of acquisition will include (referring to Smith) :

Definitions:

Agricultural Products

Items produced through farming and agriculture, including crops, livestock, and other raw goods used for food, fabric, or industry.

Price Inelastic

A characteristic of a good or service whose demand does not significantly change when its price changes.

Agricultural Products

Goods derived from farming and the cultivation of soil, including crops and livestock.

Agricultural Industry

The sector of the economy focused on the production, processing, and distribution of food, fiber, and related products.

Q3: Direct combination costs and stock issuance costs

Q3: When is the gain on an intra-entity

Q7: What happens when a U.S. company purchases

Q16: The following information has been taken from

Q46: What exchange rate should be used to

Q47: How does the existence of a non-controlling

Q48: Following are selected accounts for Green Corporation

Q54: On January 1, 2010, Jumper Co. acquired

Q70: The Town of Anthrop receives a $10,000

Q77: Brown and Green are forming a business