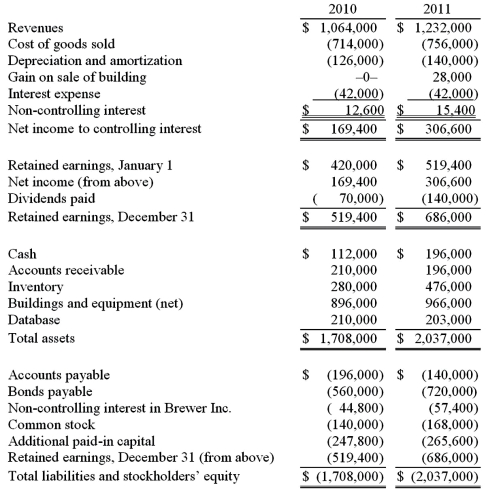

Allen Co. held 80% of the common stock of Brewer Inc. and 40% of this subsidiary's convertible bonds. The following consolidated financial statements were for 2010 and 2011.

Additional Information:

1. Bonds were issued during 2011 by the parent for cash.

2. Amortization of a database acquired in the original combination amounted to $7,000 per year.

3. A building with a cost of $84,000 but a $42,000 book value was sold by the parent for cash on May 11, 2011.

4. Equipment was purchased by the subsidiary on July 23, 2011, using cash.

5. Late in November 2011, the parent issued common stock for cash.

6. During 2011, the subsidiary paid dividends of $14,000.

Required:

Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2011. Either the direct method or the indirect method may be used.

Definitions:

Couple Therapy

A form of psychotherapy that aims to improve communication and resolve conflicts between partners in a romantic relationship.

Secondary Prevention

A health care strategy aimed at early detection and treatment of disease to halt its progression.

Primary Prevention

Prevention interventions that are designed to prevent disorders altogether.

Protective Factors

Elements in an individual's environment and personal behaviors that decrease the likelihood of developing a disease or injury.

Q7: When Jolt Co. acquired 75% of the

Q8: The board of commissioners of the city

Q17: Fargus Corporation owned 51% of the voting

Q36: Pepe, Incorporated acquired 60% of Devin Company

Q42: The capital account balances for Donald &

Q56: Assume the partnership of Howell, Madrid, and

Q57: Ginvold Co. began operating a subsidiary in

Q69: McGuire Company acquired 90 percent of Hogan

Q85: When is a goodwill impairment loss recognized?<br>A)

Q88: A forward contract may be used for