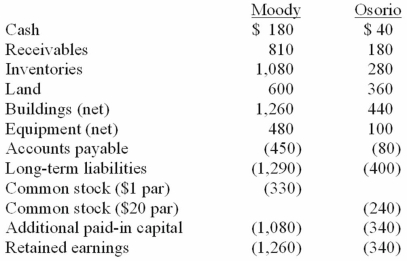

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated common stock at date of acquisition.

Definitions:

Hierarchically

In an organized manner where objects, values, or classes are ranked above one another, often used to describe structured relationships within systems.

Concept Organization

The arrangement and structuring of ideas and categories in the mind to facilitate understanding and retrieval of information.

Elaborative Rehearsal

A memory technique that involves thinking about the meaning of the term to be remembered, rather than merely repeating the word to yourself.

Mental Image

A representation of sensory experience that occurs in the absence of direct external stimuli, often visual or auditory in nature.

Q21: The financial statements for Jode Inc. and

Q24: Keefe, Inc., a calendar-year corporation, acquires 70%

Q26: The following are preliminary financial statements for

Q35: An acquisition transaction results in $90,000 of

Q37: The financial statements for Goodwin, Inc., and

Q65: Strayten Corp. is a wholly owned subsidiary

Q74: Dodge, Incorporated acquires 15% of Gates Corporation

Q78: Parent Corporation had just purchased some of

Q89: The financial statements for Goodwin, Inc., and

Q113: What is the primary difference between recording