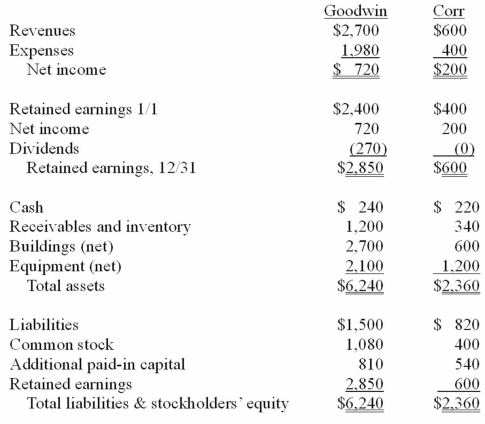

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated liabilities at December 31, 20X1.

Definitions:

Direct Labor Costs

The wages of employees who are directly involved in the production of goods or services.

Debit Balance

An accounting term describing a balance where total debits exceed total credits in an account.

Direct Labor Costs

The wages and benefits paid to employees who are directly involved in the production of a company's goods or services.

Overapplied Overhead

A situation where the allocated manufacturing overhead costs exceed the actual overhead expenses incurred.

Q4: Which of the following statements is true

Q11: Optimistically, the habitable zone of the Sun

Q25: Gargiulo Company, a 90% owned subsidiary of

Q34: Strickland Company sells inventory to its parent,

Q63: What accounting method requires a subsidiary to

Q78: By monitoring the changing brightness of a

Q79: Which is the following is the spectra

Q81: White dwarfs<br>A) are dead stars<br>B) are in

Q96: Discoveries of extrasolar planets have shown us

Q114: The financial statements for Goodwin, Inc., and