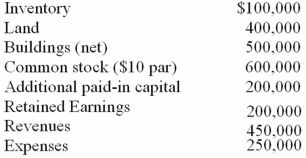

Carnes has the following account balances as of May 1, 2010 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

On May 1, 2010, what value is assigned to Riley's investment account?

Definitions:

Prescription Drugs

Medications that legally require a medical prescription to be dispensed, typically regulated by legislation to require a medical diagnosis and supervision by a licensed healthcare provider.

Diabetes Testing Supplies

Products and devices used by individuals with diabetes to monitor their blood sugar levels, such as glucose meters, test strips, and lancets.

Reseller

A business that purchases goods or services with the intention of selling them to others, rather than consuming or using them.

General Services Administration

A U.S. government agency responsible for managing and supporting the basic functioning offices of the federal government, including procurement and property management.

Q22: For each of the following situations (1

Q25: The luminosity of a star is<br>A) determined

Q32: Following are selected accounts for Green Corporation

Q38: Fine Co. issued its common stock in

Q46: McGuire Company acquired 90 percent of Hogan

Q47: Io has an elliptical orbit because<br>A) of

Q68: The financial balances for the Atwood Company

Q84: Which of the following is not a

Q86: Carnes Co. decided to use the partial

Q109: On January 3, 2011, Austin Corp. purchased