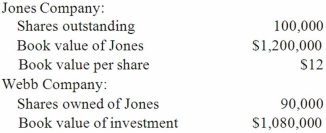

Webb Company owns 90% of Jones Company. The original balances presented for Jones and Webb as of January 1, 2013 are as follows:  Assume Jones issues 20,000 new shares of its common stock for $15 per share. Of this total, Webb acquires 18,000 shares to maintain its 90% interest in Jones.

Assume Jones issues 20,000 new shares of its common stock for $15 per share. Of this total, Webb acquires 18,000 shares to maintain its 90% interest in Jones.

What is the adjusted book value of Jones after the stock issuance?

Definitions:

Top-Down Analysis

Investment analysis approach that starts with global economy conditions before drilling down to industry and company-specific factors.

Fixed Costs

Business expenses that remain the same regardless of the level of production or sales, such as rent, salaries, or loan payments.

Variable Costs

Costs that vary directly with the level of output or production activity.

Corporate Tax Rate

The percentage of a corporation's profits that must be paid to the government as tax.

Q3: When consolidating a foreign subsidiary, which of

Q7: What are the three authoritative pronouncements that

Q10: Goehring, Inc. owns 70 percent of Harry

Q25: Certain balance sheet accounts of a foreign

Q49: What is the purpose of the U.S.

Q55: Chain Co. owned all of the voting

Q59: The financial statements for Goodwin, Inc. and

Q74: Clemente Co. owned all of the voting

Q97: On January 1, 2012, Smeder Company, an

Q101: Pell Company acquires 80% of Demers Company