Jet Corp. acquired all of the outstanding shares of Nittle Inc. on January 1, 2011, for $644,000 in cash. Of this price, $42,000 was attributed to equipment with a ten-year remaining useful life. Goodwill of $56,000 had also been identified. Jet applied the partial equity method so that income would be accrued each period based solely on the earnings reported by the subsidiary.

On January 1, 2014, Jet reported $280,000 in bonds outstanding with a book value of $263,200. Nittle purchased half of these bonds on the open market for $135,800.

During 2014, Jet began to sell merchandise to Nittle. During that year, inventory costing $112,000 was transferred at a price of $140,000. All but $14,000 (at Jet's selling price) of these goods were resold to outside parties by year's end. Nittle still owed $50,400 for inventory shipped from Jet during December.

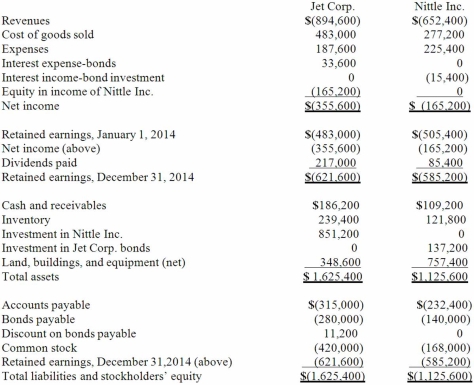

The following financial figures were for the two companies for the year ended December 31, 2014.

Required:

Prepare a consolidation worksheet for the year ended December 31, 2014.

Definitions:

Pretend Play

A type of play in which children imagine and act out scenarios, often involving role-playing or make-believe activities.

Assertiveness

The practice of expressing one's opinions and needs directly and respectfully.

Hyperfocus

An intense form of mental concentration or visualization that focuses consciousness on a narrow subject to an extreme degree.

Empathy

The ability to understand and share the feelings of another person, effectively putting oneself in their shoes.

Q24: Which of the following statements is true

Q25: On December 1, 2013, Keenan Company, a

Q40: Thomas Inc. had the following stockholders' equity

Q45: The financial balances for the Atwood Company

Q55: Paris, Inc. owns 80 percent of the

Q62: Coyote Corp. (a U.S. company in Texas)

Q62: On January 1, 2013, the Moody Company

Q78: Which of the following costs require similar

Q85: What information does U.S. GAAP require to

Q119: X-Beams Inc. owned 70% of the voting