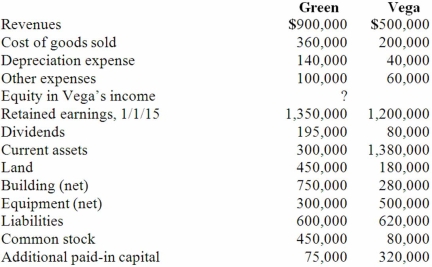

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated total expenses.

Definitions:

Emissions

The production and discharge of something, especially gas or radiation, into the environment.

Ring Topology

A network configuration where each node is connected to two other nodes, forming a single continuous pathway for signals through each node – a ring.

NIC

Network Interface Card, a hardware component that connects a computer to a network, allowing it to communicate with other computers and devices.

Networking Terminology

The specialized vocabulary used to describe and understand networks and their operations.

Q20: How are direct combination costs, contingent consideration,

Q27: DNA was isolated from a patient and

Q40: Beta Corp. owns less than one hundred

Q41: Tinker Co. owns 25% of the common

Q44: Following are selected accounts for Green Corporation

Q71: When a subsidiary is acquired sometime after

Q85: According to International Financial Reporting Standards: In

Q92: Following are selected accounts for Green Corporation

Q94: Dean, Inc. owns 90 percent of Ralph,

Q96: Acker Inc. bought 40% of Howell Co.