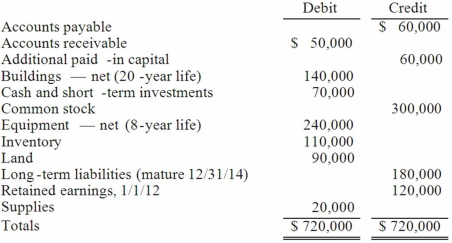

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2012. As of that date, Jackson had the following trial balance:

During 2012, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2013, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2012, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2012.

(B.) Prepare consolidation worksheet entries for December 31, 2013.

Definitions:

Expected Gain

The anticipated benefit or profit that arises from a specific action or investment.

Diversification

The process of spreading investment risks by acquiring a wide range of assets within a portfolio.

Expected Gain

A calculation or forecast regarding the potential benefits or profits that could be achieved in a specific situation or from a particular action.

Adverse Selection

A situation in insurance and finance where those most likely to produce negative outcomes are more inclined to select into or engage with a service, typically leading to higher costs for insurers or lenders.

Q4: Which is used to calibrate an instrument

Q7: Which of the following is a method

Q7: Flynn acquires 100 percent of the outstanding

Q15: Which of the following is a genetic

Q19: The financial balances for the Atwood Company

Q31: Pell Company acquires 80% of Demers Company

Q37: These questions are based on the following

Q59: The financial statements for Goodwin, Inc. and

Q74: Steven Company owns 40% of the outstanding

Q76: On January 1, 2013, Pride, Inc. acquired