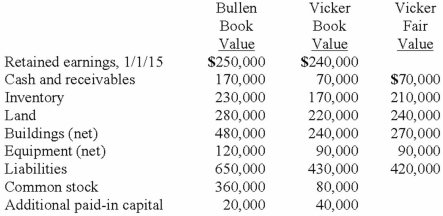

Bullen Inc. acquired 100% of the voting common stock of Vicker Inc. on January 1, 2013. The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow, along with the book value of Bullen's accounts:  Assume that Bullen paid a total of $480,000 in cash for all of the shares of Vicker. In addition, Bullen paid $35,000 to a group of attorneys for their work in arranging the combination to be accounted for as an acquisition. What will be the balance in consolidated goodwill?

Assume that Bullen paid a total of $480,000 in cash for all of the shares of Vicker. In addition, Bullen paid $35,000 to a group of attorneys for their work in arranging the combination to be accounted for as an acquisition. What will be the balance in consolidated goodwill?

Definitions:

Inventory Purchases

The buying of goods to be sold in the normal course of business operations.

Sustainable Income

Revenue that can be maintained for the foreseeable future without diminishing resources or opportunities.

Extraordinary Items

Events and transactions that are distinguished by their uncommon nature and by the infrequency of their occurrence, impacting a company's financial statements.

Continuing Operations

The parts of a business expected to continue operating into the foreseeable future, excluding discontinued operations.

Q2: A chromosome formed when parts of two

Q7: One company acquires another company in a

Q18: In a pedigree, an affected female will

Q21: Pell Company acquires 80% of Demers Company

Q24: Which is a frameshift mutation?<br>A) Loss of

Q33: Pepe, Incorporated acquired 60% of Devin Company

Q36: The financial statements for Goodwin, Inc. and

Q64: Perry Company acquires 100% of the stock

Q72: Which of the following will result in

Q72: On January 1, 2013, Riney Co. owned