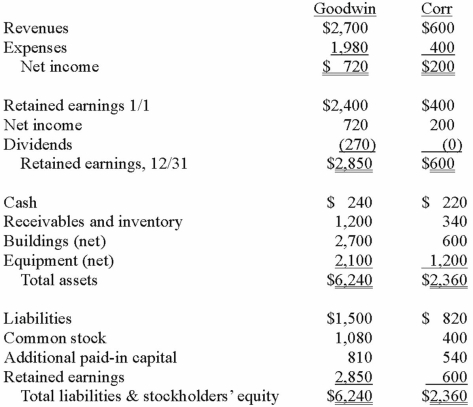

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated retained earnings at December 31, 2013.

Definitions:

Gender-Group Unity

The solidarity and collective identity formed among individuals based on their shared gender experiences or goals, often in the context of seeking social equality or rights.

Moral Purity

The state of being free from moral fault or corruption, often emphasized in religious or ethical contexts.

Theodore Roosevelt

The 26th President of the United States, known for his foreign policy, conservation efforts, and progressive reforms.

Material Progress

The advancement and accumulation of physical goods, technological advancements, and improved living standards within a society.

Q1: A Southern blot procedure has been performed,

Q8: Dithers Inc. acquired all of the common

Q17: An analysis that takes place in silico

Q22: Incomplete cleaning of the fluorescently labeled sequencing

Q23: The level of detail to which an

Q28: Fargus Corporation owned 51% of the voting

Q30: The financial balances for the Atwood Company

Q65: Royce Co. acquired 60% of Park Co.

Q66: The financial statements for Goodwin, Inc. and

Q84: Presented below are the financial balances for