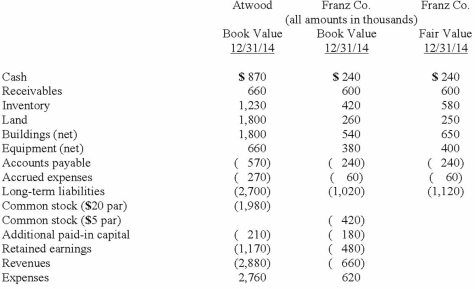

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2012, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2012. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated retained earnings as a result of this acquisition.

Definitions:

Distal Process

Distal process refers to external, environmental events, conditions, or stimuli that indirectly influence development or behavior through a chain of intermediary processes or mechanisms.

Governmental Policies

Decisions and actions taken by a government to direct and influence its country's social, economic, and political issues.

Critical Period

A specific time in development when the organism is particularly sensitive to environmental stimuli, and thus has an enhanced capacity for learning or development in a particular area.

Q4: What is TaqMan?<br>A) A qPCR probe system<br>B)

Q7: The specificity of western blots depends on

Q13: Which of the following is the most

Q13: Herceptin (trastuzumab) therapy works best on what

Q21: Missense mutations in cell growth regulator proteins

Q29: Five one- and two-base repeat loci were

Q51: On January 1, 2012, Smeder Company, an

Q53: Jansen Inc. acquired all of the outstanding

Q91: Which one of the following is a

Q127: Several years ago Polar Inc. acquired an