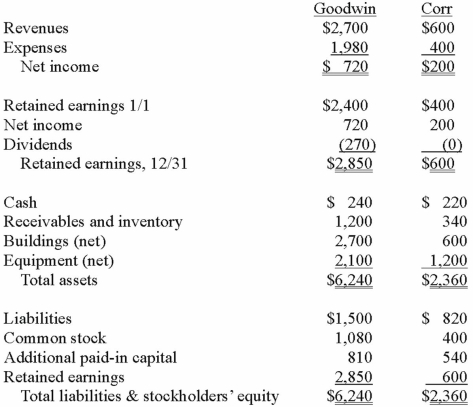

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated buildings (net) account at December 31, 2013.

Definitions:

Excellent Literacy

Superior ability in reading and writing, encompassing both the understanding of texts and the ability to communicate effectively through written language.

Life Expectancy

The average number of years an individual or population is expected to live, based on statistical analyses.

Health Care Spending

The total amount of money spent by individuals, insurance companies, and governments on health care services and products.

Social Network

A network of social interactions and personal relationships, or a platform on the internet that facilitates these interactions.

Q9: Pell Company acquires 80% of Demers Company

Q12: Which of the following statements is false

Q13: Following are selected accounts for Green Corporation

Q26: Which of the following would be most

Q49: Stark Company, a 90% owned subsidiary of

Q59: How do upstream and downstream inventory transfers

Q87: A company should always use the equity

Q94: Direct combination costs and stock issuance costs

Q115: On January 1, 2013, Pacer Company paid

Q120: From which methods can a parent choose