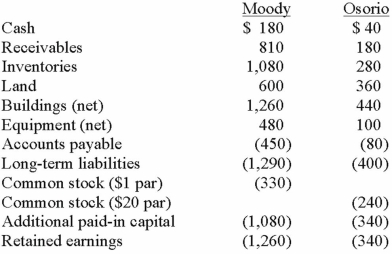

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

What amount was recorded as the investment in Osorio?

Definitions:

Dividend

A share of a firm's income allocated to its stockholders, often in cash or extra shares.

Perceivable Future

A concept referring to events or conditions that can reasonably be foreseen or predicted.

Quarterly Dividend

A payment made by a corporation to its shareholders, usually as a distribution of profits, every three months.

Par Value

The face value of a bond or stock as stated by the issuer, which bears significance for accounting and financial regulation.

Q3: DNA is isolated from a test organism

Q6: Jaynes Inc. acquired all of Aaron Co.'s

Q13: Which of the following is the most

Q16: The following methods that are used to

Q26: Which of the following is the correct

Q82: During 2012, Von Co. sold inventory to

Q92: Following are selected accounts for Green Corporation

Q98: Which of the following statements is false

Q109: Bauerly Co. owned 70% of the voting

Q114: Kaye Company acquired 100% of Fiore Company