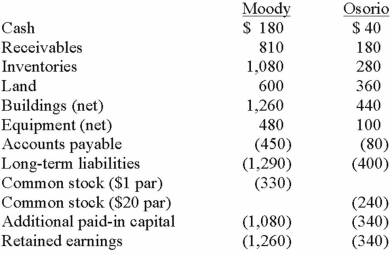

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated buildings (net) at date of acquisition.

Definitions:

Stratified Random Sampling

A method of sampling that involves dividing a population into strata, or groups, and then selecting random samples from each stratum to ensure representation across the population.

Sampling

The process of selecting a subset of individuals from a population to represent the whole, used in statistical analysis and research studies.

Snowball Sampling

A non-random sampling technique where existing study subjects recruit future subjects from among their acquaintances.

Replicate Features

The duplication or reproduction of certain characteristics or functionalities in a study or system to ensure repeatability or reliability.

Q1: Which of the following types of chromatin

Q3: In order to depurinate DNA after electrophoresis,

Q7: What does the g designate in g.225A>C?<br>A)

Q10: Down's syndrome is caused when an extra

Q15: The financial statements for Goodwin, Inc. and

Q26: Pell Company acquires 80% of Demers Company

Q29: On January 1, 2013, Parent Corporation acquired

Q53: Steven Company owns 40% of the outstanding

Q84: On January 4, 2013, Mason Co. purchased

Q93: On January 1, 2015, Elva Corp. paid