The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

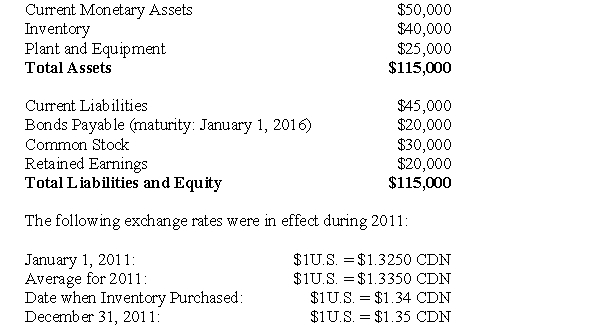

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

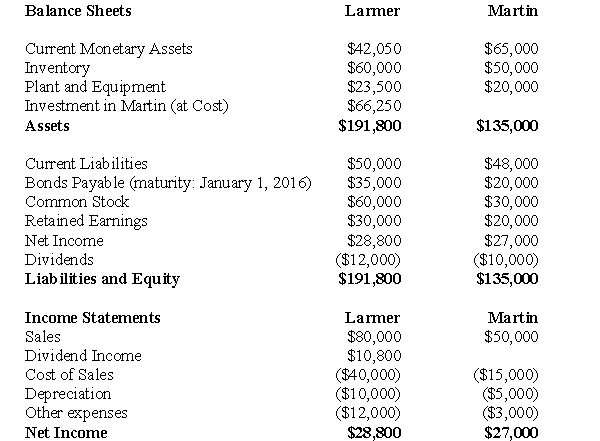

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Translate Martin's December 31,2011 Balance Sheet into Canadian dollars.

Definitions:

Signs

Objects, gestures, or marks used to convey information, instructions, or identifications.

Primary Liable

Being the first or main party responsible for fulfilling an obligation or compensating for damages.

Co-signs

The act of signing a loan or agreement jointly with another person, thereby assuming equal responsibility for the repayment.

Collectively

refers to actions or measures taken as a whole by a group of people or entities.

Q1: Blackmon Co. is deciding between two compensation

Q16: Ignoring taxes,what is the total amount of

Q22: The amount of gross profit appearing on

Q27: Assuming that the assets were purchased from

Q31: Which of the following rates would be

Q45: What is the total amount of intercompany

Q51: Compute MAX's Goodwill at the Date of

Q62: Cosby Company is attempting to develop the

Q74: What is the total amount of other

Q168: Anya is the marketing manager at Education