The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

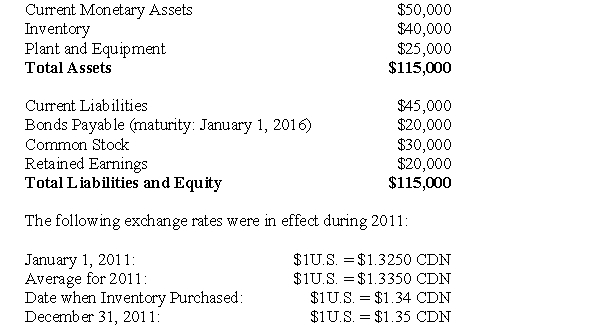

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

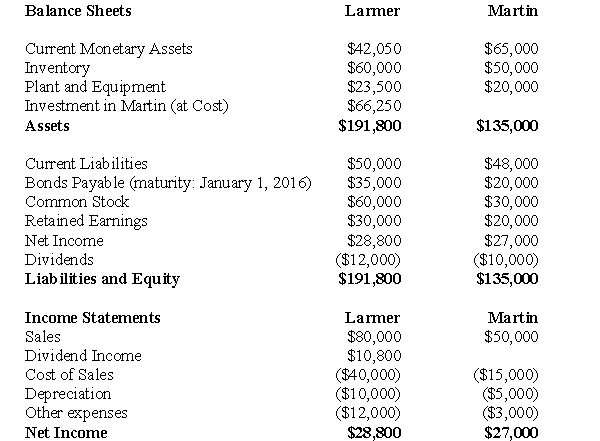

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Calculate Larmer's Consolidated Net Income for 2011.

Definitions:

Medial Forebrain Bundle

A pathway in the brain involved in the mediation of reward and pleasure through the transmission of dopamine.

Motivated Behaviors

Activities or actions that are driven by a desire to fulfill certain needs or goals, often reflecting underlying psychological or physiological processes.

Lactating

The process of producing and secreting milk from the mammary glands to feed infants.

Hormone

A chemical substance produced in the body that controls and regulates the activity of certain cells or organs.

Q4: Assuming that GNR owned 80% of NXR

Q10: Prepare Jean Inc's consolidated Balance Sheet on

Q14: Which of the following rates would be

Q18: Parent Company acquires Sub Company's common shares

Q19: A scatter plot is especially useful when

Q26: What is the amount of the temporary

Q37: The amount of Non-Controlling Interest on Big

Q43: Under the Proprietary theory,Non-Controlling Interest is<br>A)non-existent.Goodwill is

Q55: List one assumption made when a linear

Q103: Accounting information is the only thing managers