The following information pertains to questions

Canada Corp.sells raw lumber to a number of countries around the world.On December 1,2013 the company shipped some lumber to a client in Japan.The selling price was established at 500,000 Yen with payment to be received on March 1,2014.

On December 3,2013 the company entered into a hedge with a Canadian Bank at the 90 day forward rate of 1Yen=$1.185CDN.

Canada Corp received the payment from its Japanese client on March 1,2014.Canada Corp's year end is on December 31.

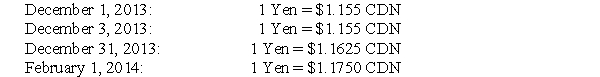

Selected spot rates were as follows:

-Prepare the journal entries to record the receipt of the 500,000 Yen on March 1,2014,assuming that Canada Corp did not enter into a hedge transaction in December 2013.

Definitions:

Expenses

Monetary costs incurred in the operation of a business, leading to the creation of liabilities or decrease in assets.

Basic Accounting Equation

The fundamental equation of double-entry bookkeeping, stating that assets equal liabilities plus owner's equity.

Transaction

An agreement or exchange between two parties that has a measurable financial effect on the accounts of a business.

Accounts

Financial records of transactions that track the income, expenses, assets, liabilities, and equity of an entity.

Q3: Approximately what percentage of the non-controlling interest

Q12: Assume that the facts provided above with

Q19: What effect would the intercompany bond sale

Q27: Assume that Parent Inc.decides to prepare an

Q32: The amount of Retained Earnings appearing on

Q91: Learning curves lead to greater productivity over

Q110: Dakota Gold sells gold bracelets for $40

Q111: A learning curve is the rate at

Q133: Jackie's Kennels is located in a small

Q155: All of the following data can be