The following information pertains to questions

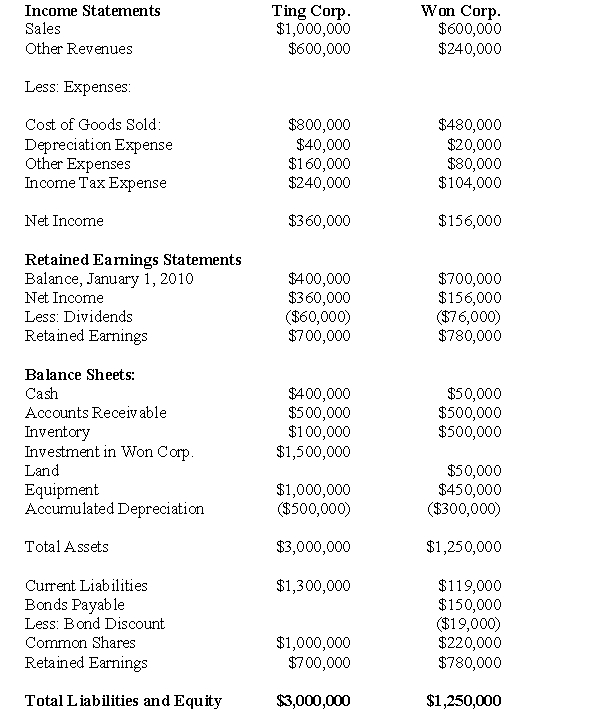

Ting Corp.owns 75% of Won Corp and uses the Cost Method to account for its Investment,which it acquired on January 1,2010 The Financial Statements of Ting Corp and Won Corp for the Year ended December 31,2010 are shown below:  Other Information:

Other Information:

Won sold a tract of land to Ting at a profit of $20,000 during 2010.This land is still the property of Ting Corp.

On January 1,2010,Won sold equipment to Ting at a price that was $20,000 lower than its book value.The equipment had a remaining useful life of 5 years from that date.

On January 1,2010,Won's inventories contained items purchased from Ting for $120,000.This entire inventory was sold to outsiders during the year.Also during 2010,Won sold inventory to Ting for $30,000.Half this inventory is still in Ting's warehouse at year end.All sales are priced at a 20% mark-up above cost,regardless of whether the sales are internal or external.

Won's Retained Earnings on the date of acquisition amounted to $400,000.There have been no changes to the company's common shares account.

Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a fair value that was $50,000 higher than its book value

▫ A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000.The patent had an estimated useful life of 5 years.

▫ There was a goodwill impairment loss of $10,000 during 2010

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization exclusively.

▫ On January 1,2010,Ting acquired half of Won's bonds for $60,000

▫ The bonds carry a coupon rate of 10% and mature on January 1,2030.The initial bond issue took place on January 1,2010.The total discount on the issue date of the bonds was $20,000.

▫ Gains and losses from intercompany bondholdings are to be allocated to the two companies when consolidated statements are prepared.

-What effect would the intercompany bond sale have on Ting's December 31,2010 Consolidated Income Statement?

Definitions:

Neurotic

Referring to an individual's tendency towards anxiety, depression, or other emotional instability, often as a personality trait.

Theory

An explanation for how and why variables are related to each other.

Hypotheses

Propositions or assumptions made for the sake of argument or investigation, to be tested through research.

Discarded

Objects, substances, or ideas that have been thrown away or rejected as no longer useful or relevant.

Q11: A Inc.is contemplating a Business combination with

Q14: For each pair of sentences, select the

Q21: Compute consolidated inventory for Ash as at

Q23: Pedro has recently experienced a run of

Q30: The amount of deferred taxes appearing on

Q30: How much (in Canadian Dollars)will RXN expect

Q33: Starting in 2011,what is the definition of

Q40: Eastwood Consulting rents a photocopy machine for

Q54: The amount of goodwill appearing on Big

Q88: Whether a given type of information is