The following information pertains to questions

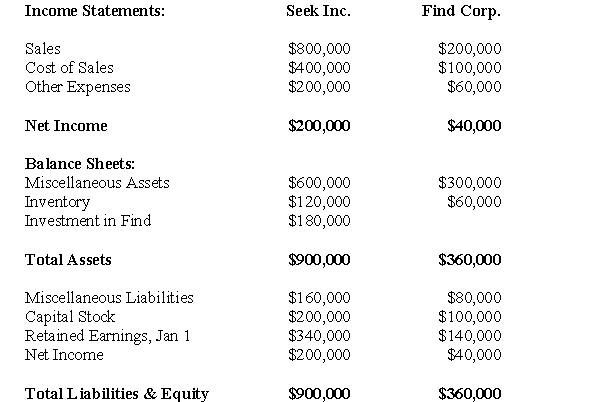

Find Corp.is a joint venture in which Seek Inc.has a 20% interest.Seek uses the equity method to account for its investment but has yet to make any journal entries for 2010.The financial statements of both companies are shown below on December 31,2010.  During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

Seek shall use the proportionate consolidation method (current Canadian GAAP) to report its investment in Find Corp.for 2010.Both companies are subject to 40% tax rate.

-What is the total amount of deferred taxes that would appear on Seek's Consolidated Balance Sheet as at December 31,2010?

Definitions:

1, 1 And 5, 5

Refers to positions on a grid in managerial grid models that classify leadership styles; "1,1" is low task, low relationship, while "5,5" represents high task, high relationship.

Team

A group of individuals working together towards a common goal, leveraging diverse skills and collaborative efforts.

Blake And Mouton's Leadership Grid

A managerial framework that uses concern for people and production to categorize leadership styles, promoting a balanced approach for effectiveness.

Country Club

An approach to management characterized by a high concern for people but low concern for production, leading to a comfortable and friendly atmosphere but potentially lower levels of productivity.

Q3: Assuming that a company's ownership interest in

Q4: What is the amount of the foreign

Q29: What is the amount of interest expense

Q39: What would be the carrying value of

Q40: Prepare the journal entries to record the

Q45: What would be the journal entry to

Q55: Translate Martin's 2011 Income Statement into Canadian

Q61: Company A makes a hostile take-over bid

Q111: Which of the following adjectives describes higher

Q131: Which of the following statements is true?<br>A)Opportunity