The following information pertains to questions 53 through 55 inclusively.Analysis and calculations should be made under current Canadian GAAP.

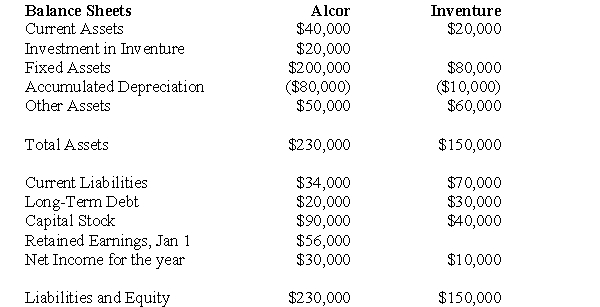

Alcor and Vax Inc.formed a joint venture on January 1,2010 called Inventure Inc.Alcor and Vax each hold a 50% in the venture and share equally in any profits or losses arising from the venture.

The following statements were prepared on December 31,2010.  Other Information:

Other Information:

During 2010,Inventure purchased $10,000 from Alcor.Alcor recorded a gross profit of $2,000 on these sales.

On December 31,2010,Inventure's inventories contained half of the merchandise purchased from Alcor.Alcor uses the Cost Method to account for its Investment in Inventure.Alcor wishes to comply with Section 3055 of the CICA Handbook.An income tax allocation rate of 20% applies.

-Using only the Revenue test,which of the following segment(s) would be reportable?

Definitions:

Vegetarian Diet

A dietary choice abstaining from consuming meat, fish, and sometimes, animal by-products, focusing on plants for food.

Americans

residents or citizens of the United States of America.

Meatless Diet

A diet that excludes all types of meat, including beef, poultry, and fish, often adopted for health, ethical, or environmental reasons.

Animal Products

Items derived from parts of animals, such as meat, dairy, and wool, used for food, clothing, or other purposes.

Q6: The amount of bonds payable appearing on

Q38: What approach did Canada decide to take

Q44: The major disadvantage of the high-low method

Q55: A significant influence investment is one that:<br>A)allows

Q59: What would be the amount of the

Q75: Past cost information, although accurate in predicting

Q97: The steps for using regression analysis to

Q115: Cosby Company is attempting to develop the

Q140: The average cost of producing 200 units

Q157: When the cost object is a unit