The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

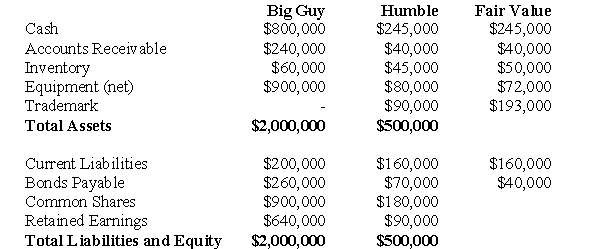

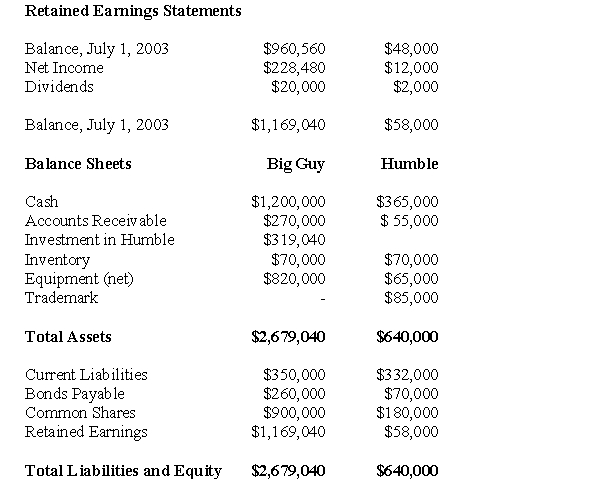

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

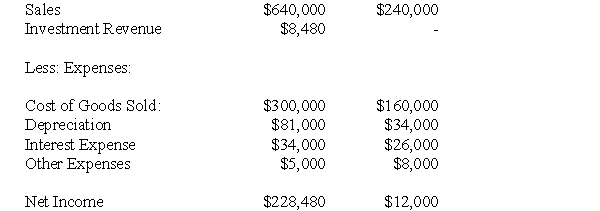

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of bonds payable appearing on Big Guy's Consolidated Balance Sheet on July 1,2004 would be:

Definitions:

Binomial Probability

The probability of obtaining a fixed number of successful outcomes in a fixed number of trials in a binomial experiment.

Odds

The ratio of the probability of an event happening to the probability of it not happening; in gambling, it represents the amount won relative to the stake.

Unfriended

The act of removing someone from one's social networking friends list.

Probability

The quantification of the chance of an event happening, represented as a number from 0 to 1, with 0 meaning the event is impossible and 1 meaning the event is certain.

Q11: The subject of this paragraph is<br>A) finding

Q18: Calculate the non-controlling interest (Balance Sheet)as at

Q26: What is the amount of the temporary

Q27: What would be the balance in the

Q34: How many categories are there?<br>A) two<br>B) three<br>C)

Q36: The amount of depreciation expense appearing on

Q39: What would be the carrying value of

Q41: Assuming that Plax uses the equity method,prepare

Q50: Which of the following is the correct

Q82: (CMA)When comparing strategic planning with operational planning,