Analysis and calculations should be based on the requirements of current Canadian GAAP.

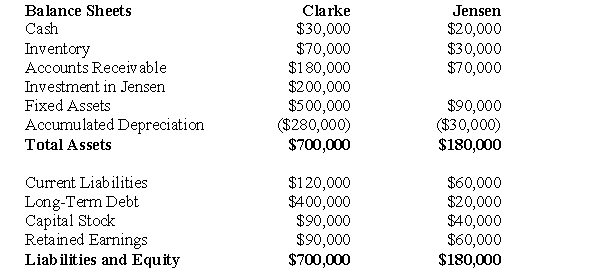

The following balance sheets have been prepared on December 31,2010 for Clarke Corp.and Jensen Inc.  Additional Information:

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen,which it acquired on January 1,2007.On that date,Jensen's retained earnings were $20,000.The acquisition differential was fully amortized by the end of 2010.

Clarke sold Land to Jensen during 1999 and recorded a $15,000 gain on the sale.Clarke is still using this Land.Clarke's December 31,2010 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2010 interest-free.Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

-Prepare a Balance Sheet for Clarke on December 31,2010 in accordance with current Canadian GAAP,assuming that Clarke's investment in Jensen is a significant influence investment.

Definitions:

Process

A series of actions or steps taken to achieve a particular end, often described in manufacturing, project management, or business procedures.

Procedure

A set of established methods or steps taken to accomplish a particular task or to solve a specific problem.

Internal Marketing

The promotion of a company’s objectives, products, and services to its employees with the goal of aligning external marketing strategies.

Environmental Appearance

Environmental appearance relates to the visual aspect of an environment, including how clean, attractive, and ecologically responsible it is.

Q1: What is the after-tax dollar value of

Q4: What is the amount of Goodwill that

Q8: The degree of accounting disclosure required tends

Q18: Parent Company acquires Sub Company's common shares

Q28: Explain how the amount was derived for

Q45: Prepare MAX's Consolidated Statement of Financial Position

Q49: Explain how scatter plots are used in

Q55: Translate Martin's 2011 Income Statement into Canadian

Q80: Organizational strategies:<br>A)Are reconsidered on a daily basis<br>B)Should

Q94: Preparing a scatter plot is a requirement