Analysis and calculations should be made based on current Canadian GAAP.

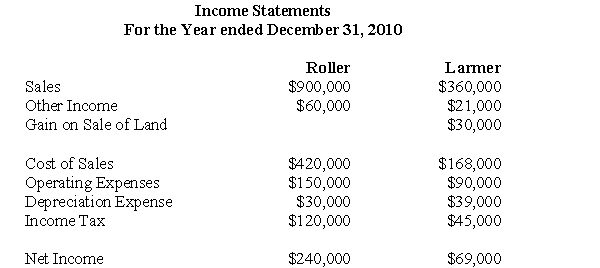

The following are the 2010 Income Statements of Roller Corp and Larmer Corp.  Other Information:

Other Information:

During 2010 Larmer paid dividends of $24,000.Roller acquired its 30% stake in Roller at a cost of $400,000 and uses the cost method to account for its investment.Roller's investment in Larmer shall not be considered a control investment.

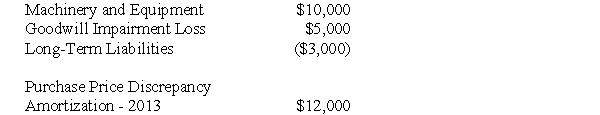

The acquisition differential amortization schedule showed the following write-off for 2010:  During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

In 2010,Roller sold Land to Larmer and recorded a profit of $10,000 on the sale.During 2010,Larmer sold the land to a third party.

Both companies are subject to a 40% tax rate.

-Assuming that Larmer is NOT a joint venture and that it is also NOT a portfolio investment,prepare Roller's 2010 Income Statement in accordance with current Canadian GAAP.

Definitions:

Superordinate Goals

Objectives that are shared and valued by members of a group, which require collaborative effort to achieve, thus helping to resolve conflicts and unify the group.

Interaction

The process by which two or more entities communicate or affect each other in some way.

Cooperation

Cooperation is the process of groups or individuals working together towards a common goal, often resulting in mutual benefits or achieving shared objectives.

Compliance Conformity

Adjusting one's behavior or beliefs to match those of others, often in response to explicit or implicit social pressure.

Q7: When the Non-Controlling Interest's share of the

Q9: Prepare Alpha's Consolidated Income Statement for the

Q14: Relevant information for decisions can focus both

Q26: What would be the journal entry to

Q34: Prepare a schedule of intercompany items as

Q40: Eastwood Consulting rents a photocopy machine for

Q41: Assuming that Keen Inc.purchases 80% of Lax

Q46: What would be Errant's journal entry to

Q92: The high-low method is a specific application

Q153: Bob and James are installing new flooring