The following information pertains to questions

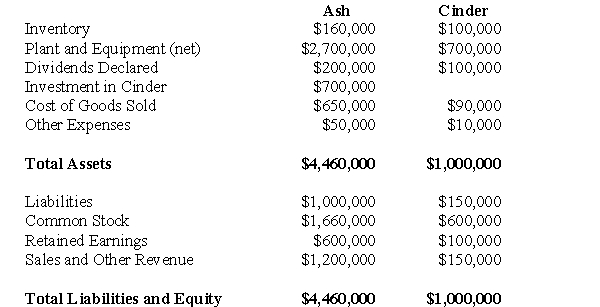

The trial balances of Ash Inc.and its subsidiary Cinder Corp.on December 31,2006 are shown below:  Other Information:

Other Information:

Ash acquired Cinder in three stages:

January 1,2006: Ash purchased 10,000 shares for $100,000.Cinder's Retained Earnings were $40,000 on that date.

January 1,2008: Ash purchased 30,000 shares for $450,000.Cinder's Retained Earnings were $80,000 on that date.

December 31,2009: Ash purchased 20,000 shares for $150,000.Cinder's Retained Earnings were $100,000 on that date.

Cinder was incorporated on January 1,2004.On that date,Cinder issued 100,000 voting shares.Any difference between the cost and book value for each acquisition is attributable entirely to trademarks,which are to be amortized over 5 years.The company has neither issued nor retired shares since the Date of Incorporation.

Ash sold depreciable assets to Cinder at a loss of $20,000 on January 1,2008.These assets had a 10 year remaining life.

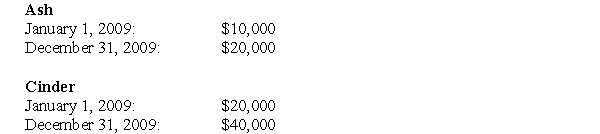

Intercompany Sales of Inventory amounted to $250,000.Unrealized inventory profits for each company are shown below for 2009.The amounts indicate the amount of profit in each company's inventory.  All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

-Compute consolidated trademarks for Ash as at December 31,2009.

Definitions:

Information Storage

The methods and technologies used to save and maintain data for future retrieval and use.

Analytic Coding

A process in qualitative research where data is categorized to facilitate analysis, identifying patterns and themes.

Descriptive Coding

A qualitative data analysis method where segments of text are summarized with a short phrase or word as a code.

Q19: What is the amount of CMI's foreign

Q25: Under the Temporal Method:<br>A)The relationship of balance

Q27: Prepare a detailed calculation of Consolidated Net

Q32: The purpose of this paragraph is to<br>A)

Q41: At what amount (in Canadian Dollars)would the

Q43: Which of the following is closest to

Q45: What would be the journal entry to

Q52: Which of the following rates would be

Q57: Assuming once again that GNR owned 80%

Q101: Maude is considering opening her own business,