The following information pertains to questions

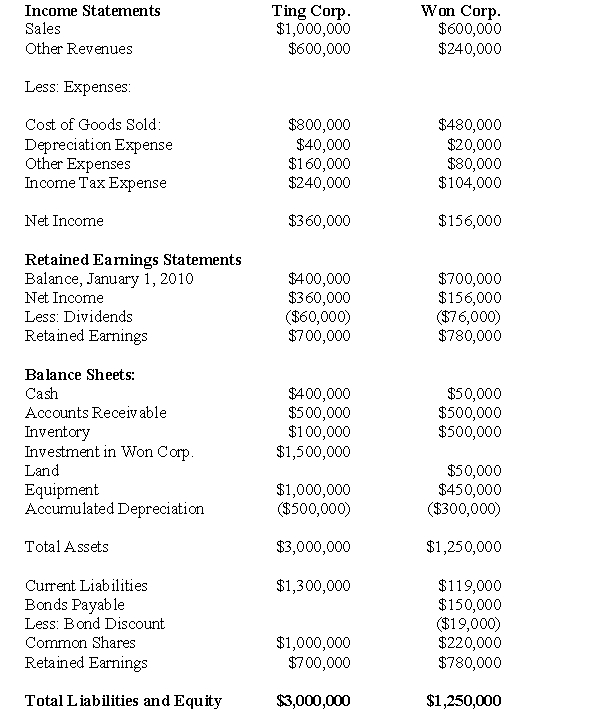

Ting Corp.owns 75% of Won Corp and uses the Cost Method to account for its Investment,which it acquired on January 1,2010 The Financial Statements of Ting Corp and Won Corp for the Year ended December 31,2010 are shown below:  Other Information:

Other Information:

Won sold a tract of land to Ting at a profit of $20,000 during 2010.This land is still the property of Ting Corp.

On January 1,2010,Won sold equipment to Ting at a price that was $20,000 lower than its book value.The equipment had a remaining useful life of 5 years from that date.

On January 1,2010,Won's inventories contained items purchased from Ting for $120,000.This entire inventory was sold to outsiders during the year.Also during 2010,Won sold inventory to Ting for $30,000.Half this inventory is still in Ting's warehouse at year end.All sales are priced at a 20% mark-up above cost,regardless of whether the sales are internal or external.

Won's Retained Earnings on the date of acquisition amounted to $400,000.There have been no changes to the company's common shares account.

Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a fair value that was $50,000 higher than its book value

▫ A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000.The patent had an estimated useful life of 5 years.

▫ There was a goodwill impairment loss of $10,000 during 2010

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization exclusively.

▫ On January 1,2010,Ting acquired half of Won's bonds for $60,000

▫ The bonds carry a coupon rate of 10% and mature on January 1,2030.The initial bond issue took place on January 1,2010.The total discount on the issue date of the bonds was $20,000.

▫ Gains and losses from intercompany bondholdings are to be allocated to the two companies when consolidated statements are prepared.

-What is the amount of unamortized acquisition differential on December 31,2010?

Definitions:

Cyber-Squatting

The practice of registering, selling, or using a domain name with the intent of profiting from the goodwill of a trademark belonging to someone else.

Domain Names

The name assigned to an Internet site, which consists of multiple parts, separated by dots, that are translated from right to left.

Trademark

A legal designation of exclusive use of a name, logo, or symbol to identify and protect a brand or product.

Fraudulent Affiliate

An affiliate that engages in deceptive practices to earn commissions from a partner program without adding real value.

Q12: For each pair of sentences, select the

Q14: For each pair of sentences, select the

Q18: On January 1,2001,Joyce Inc.paid $600,000 to purchase

Q19: _. Eggs are a great source of

Q20: Prepare Larmer's December 31,2011 Consolidated Balance Sheet.

Q30: Clustering is a task that should be

Q32: Telnor Corporation (whose year end is December

Q36: The amount of net income appearing on

Q51: Under which of the following scenarios would

Q102: Strawser Company is developing a cost function