inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

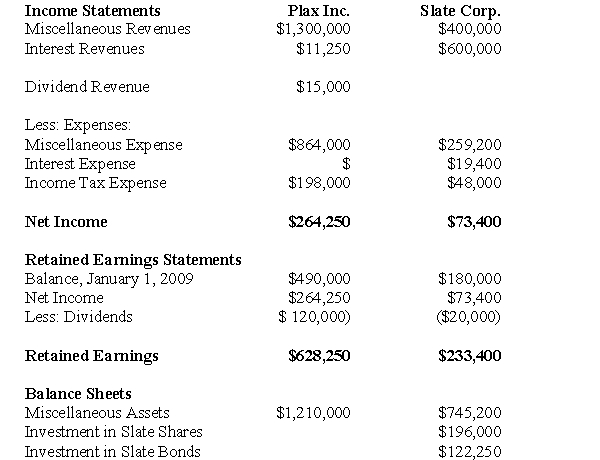

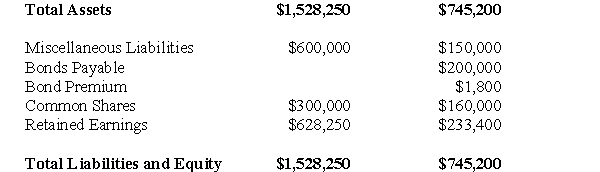

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare a Statement of Consolidated Retained Earnings for the year ended December 31,2003 for Plax Inc.

Definitions:

Net Operating Income

A financial metric that calculates a company's profit after subtracting operating expenses but before interest and taxes.

Single Product

A business strategy or market condition where a company focuses on and sells only one product.

Absorption Costing

A costing method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - in the price of a product.

Net Operating Income

The profit a company makes after deducting operating expenses from gross income, excluding interest and taxes.

Q11: For each pair of sentences, select the

Q12: Subject: swinging a golf club <br>Audience: people

Q19: What is the amount of CMI's foreign

Q34: The amount of non-controlling interest appearing on

Q34: Prepare a schedule of intercompany items as

Q39: Approximately what percentage of the non-controlling interest

Q46: Ronen Corporation owns 35% of the outstanding

Q48: Intercompany profits on sales of inventory are

Q102: Strawser Company is developing a cost function

Q116: John is creating next year's budget for