inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

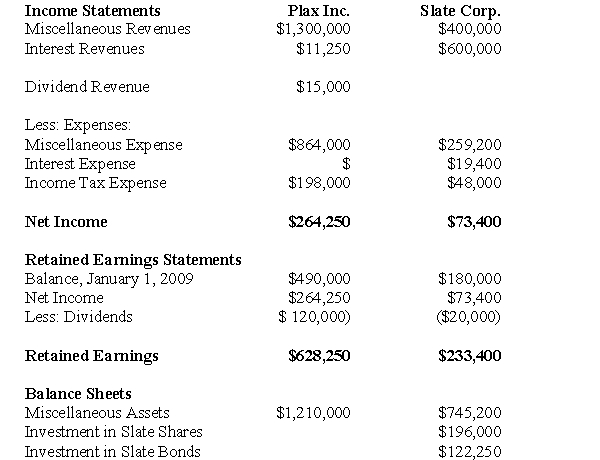

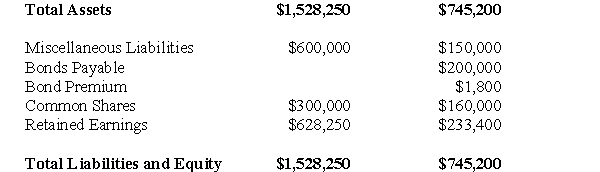

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Assuming that Plax uses the equity method,prepare a computation showing the balance in Plax's investment in Slate account on December 31,2009.

Definitions:

Principle-Based Statement

A declaration or assertion that is grounded in established principles or fundamental truths.

Code of Ethics

A set of principles and standards that guides ethical professional conduct and decision making within an organization.

Ethical Tolerances

The degree to which behavior deviating from ethical norms is accepted or allowed within a group, organization, or society.

Ethics Ombudsperson

An official given the responsibility of corporate conscience who hears and investigates ethical complaints and informs top management of potential ethical issues.

Q3: Our solar system can be envisioned as

Q24: Under IFRS 10,when can a venturer recognize

Q29: Assuming that Hanson had no recorded goodwill

Q31: Which of the following rates would be

Q37: The amount of Non-Controlling Interest on Big

Q40: Prepare the journal entries to record the

Q46: What is the carrying value of the

Q50: Assuming once again that GNR owned 80%

Q67: DEF Inc.is contemplating a business combination involving

Q80: Organizational strategies:<br>A)Are reconsidered on a daily basis<br>B)Should