The following information pertains to questions

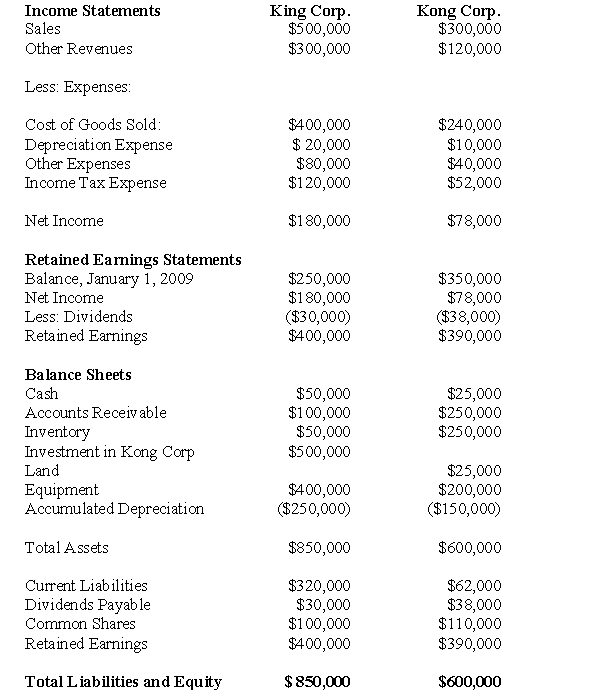

King Corp.owns 80% of Kong Corp and uses the cost method to account for its investment,which it acquired on January 1,2009.The Financial Statements of King Corp and Kong Corp for the Year ended December 31,2009 are shown below:  Other Information:

Other Information:

King sold a tract of Land to Kong at a profit of $10,000 during 2009.This land is still the property of Kong Corp.

On January 1,2009,Kong sold equipment to King at a price that was $20,000 higher than its book value.The equipment had a remaining useful life of 4 years from that date.

On January 1,2009 King's inventories contained items purchased from Kong for $10,000.This entire inventory was sold to outsiders during the year.Also during 2009,King sold Inventory to Kong for $50,000.Half this inventory is still in Kong's warehouse at year end.All sales are priced at a 25% mark-up above cost,regardless of whether the sales are internal or external.

Kong's Retained Earnings on the date of acquisition amounted to $250,000.There have been no changes to the company's common shares account.

Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a Fair value that was $20,000 higher than its book value.This inventory was sold to outsiders during 2009.

▫ A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000.The patent had an estimated useful life of 3 years.

▫ There was a goodwill impairment loss of $4,000 during 2009.

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization.

-Ignoring income taxes and any minority interest effects,what is the amount of unrealized profit remaining from the intercompany sale of equipment at December 31,2009?

Definitions:

Social Change

The variation in societal norms and cultural values over time, which impacts the way individuals and communities live and interact.

Worth

The value or importance of something, often measured in terms of money, effectiveness, or intrinsic merit.

Private Foundations

Nonprofit organizations funded by a single source, like a family or corporation, to support charitable activities.

Tax Deductible

Refers to expenses that can be subtracted from taxable income, reducing the overall amount of tax owed to the government.

Q2: Prepare a Balance Sheet for Clarke on

Q11: What is the TOTAL amount of CMI's

Q12: Assuming that the assets were purchased from

Q13: Consolidated Retained Earnings include:<br>A)Consolidated Net Income less

Q23: During an acquisition,when should intangible assets NOT

Q29: Which of the following statements is correct?<br>A)Under

Q34: Accounting policies created in countries governed by

Q42: The amount of non-controlling interest in earnings

Q60: What is the tax basis of this

Q69: An organizational vision is sometimes broken down